Hey everyone, it’s your boy here, back with another one of my little projects. Today, I’m diving into something I’ve been messing around with for a while now: trade value charts. Yeah, sounds kinda boring, but trust me, it’s pretty cool once you get into it.

So, I started this whole thing because I wanted to get better at understanding, you know, how stocks and stuff move. I mean, I’ve been throwing my money into the market like a headless chicken. Time to get a grip, right?

First thing I did was start reading up on these charts. Not gonna lie, a lot of it went straight over my head. But I found some simple explanations that broke down the basics like “open,” “high,” “low,” and “previous close.” These are just the prices where a stock starts trading, the highest and lowest it goes, and where it ended the day before.

Getting My Hands Dirty

After getting a basic understanding, I started to actually play with some charts. I used to just stare at them, I had no clue what I was seeing. But then I learned about this “10 am rule.” Apparently, you’re not supposed to make any big moves before 10 am because the market’s still figuring itself out. Made sense to me, so I started watching what happened after that time.

I also started to follow the news, it is very important, guys. You need to know what the information is going on before you make a decision.

Drawing on Charts

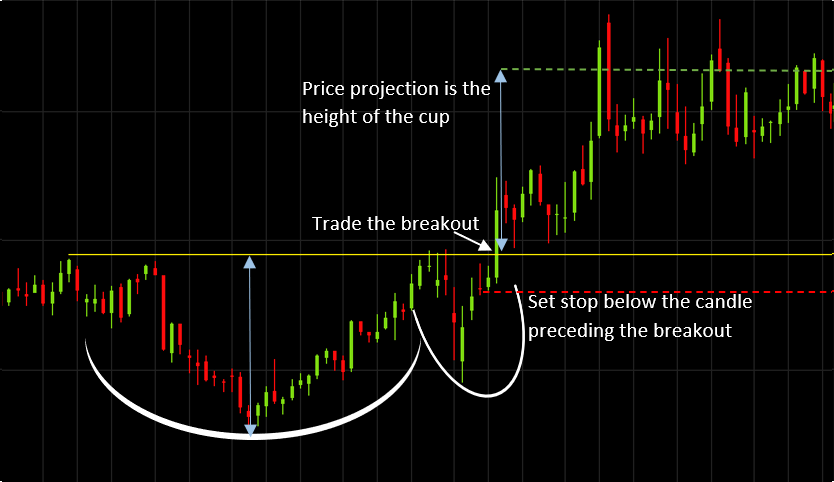

Here’s where it got fun. I learned that you could draw lines on these charts and they actually mean something. It’s like predicting the future, but with, like, data and stuff. I started with some basic trend lines, just to see where things were generally heading. Not gonna lie, my first few attempts looked like a toddler got loose with a crayon. But hey, you gotta start somewhere.

Digging Deeper

Once I got a bit more comfortable, I started looking into some more detailed stuff. Like, I learned about the P/E ratio, which is basically how much you’re paying for a company’s earnings. Then there’s this thing called “beta,” which tells you how risky a stock is compared to the whole market. And, of course, dividends – who doesn’t love getting paid just for owning a stock?

Putting It All Together

So, after weeks of doing all this, I finally felt like I was starting to get somewhere. I started making some small trades based on what I was seeing in the charts and, you know, actually thinking about what I was doing. I even managed to make a little bit of money! Nothing crazy, but it was way better than losing my shirt like I used to.

What I’ve Learned

Here’s the bottom line: these trade value charts, they’re not just for the Wall Street big shots. Regular folks like us can use them too. It just takes a bit of time and effort to figure things out. And yeah, it can be a bit rough at first, but once you start seeing how it all connects, it’s actually pretty rewarding.

I’m still learning, of course. But now, I feel a lot more confident about what I’m doing in the market. It’s not just guesswork anymore; it’s more like… informed guessing, haha. Anyway, that’s my little journey with trade value charts. Hope you guys found it interesting. Catch you in the next one!