Today, I want to talk about my recent experience with Treasury Bills, or T-bills. It’s something I’ve been messing around with, and I thought it’d be cool to share what I’ve learned and how it all went down.

So, first off, I started digging into what T-bills actually are. Turns out, they’re like short-term loans you give to the U.S. government. They can be anywhere from a few weeks to a year long. I thought that sounded pretty safe since it’s backed by the government and all.

Getting Started

I decided to go through TreasuryDirect, which is the U.S. Treasury’s website. Seemed like the easiest way to buy them online. I set up an account, which was pretty straightforward. I just had to put in some personal info and link my bank account.

Buying the T-bills

Now, here’s where it got interesting. T-bills are sold at a discount. So, you buy them for less than their face value, say, you buy a $100 T-bill, but you might only pay $98 for it. The difference is basically your interest.

I chose a few different bills with various maturity dates. I wanted to see how the yields would differ. You can buy them in increments of $100, and I didn’t have a ton to invest, so I stuck with smaller amounts at first.

The Waiting Game

After buying them, it was just a matter of waiting. It’s not like stocks where you’re checking the price every day. I just had to sit tight until they matured.

Cashing Out

Once the T-bills hit their maturity date, the face value was automatically deposited into my TreasuryDirect account. Then, I could transfer that money back to my bank. It was all pretty smooth, no hiccups or anything.

What I Learned

- T-bills are super safe: Since they’re backed by the U.S. government, there’s basically no risk of losing your money.

- They’re easy to buy: TreasuryDirect made the whole process a breeze.

- Returns are modest: You’re not gonna get rich off T-bills, but it’s a safe place to park some cash.

- Interest rates matter: The yield you get depends on the overall interest rate environment. I found that the 3-month T-bill rate was around 4.23%, which is pretty decent compared to long-term averages.

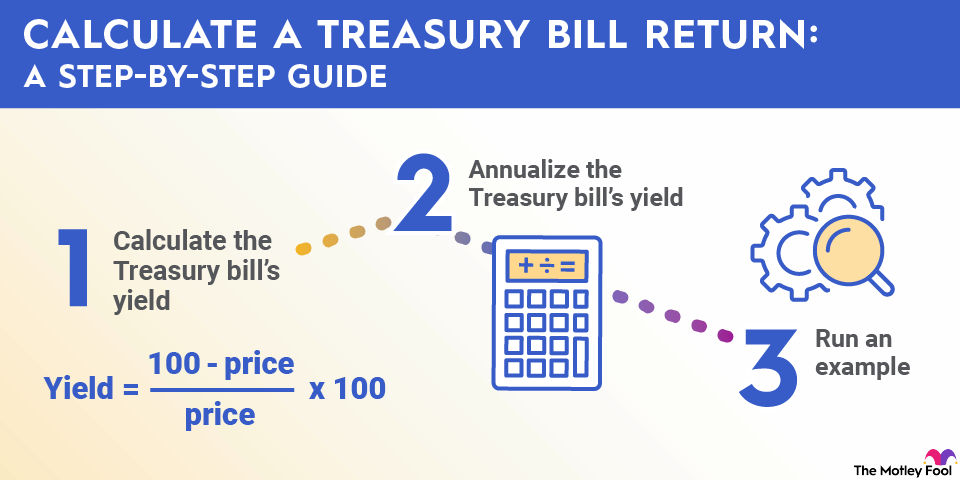

- Calculating yield is straightforward: You just subtract the purchase price from the face value and divide by the purchase price. It’s basic math.

Overall, it was a good experience. I’m not sure if T-bills are going to be a huge part of my investment strategy, but it’s nice to know they’re there as an option. Plus, I learned a lot through the process, and that’s always a win in my book.

Anyway, that’s my T-bill story. Hope you found it interesting or at least a little bit helpful. If you’ve got any questions or want to share your own experiences, feel free to do so!